New Hires

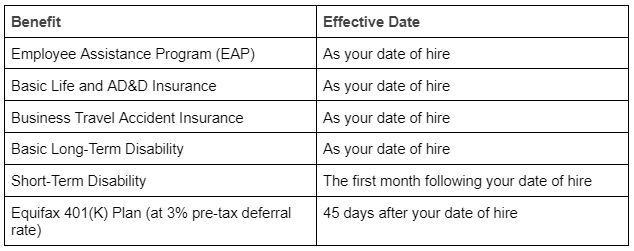

Your Equifax benefits can help you protect what matters most to you, like your health, your family, and your financial future. But to take advantage of all of these benefits, you must act.

Be sure you understand what’s available to you by viewing the benefits guide, this site, and PeopleLink, and then enroll online in Workday.

Be sure you understand what’s available to you by viewing the benefits guide, this site, and PeopleLink, and then enroll online in Workday.